Understanding NAV: Why It Matters for Investor’s Success

Introduction

If you’ve ever looked into mutual funds, you’ve probably come across the term NAV (Net Asset Value). It’s one of those finance terms that sounds complicated, but in reality, it’s pretty simple.

Think of NAV like the price tag on a mutual fund. It tells you how much one unit of the fund costs at a given time. But does that mean a mutual fund with a lower NAV is a better deal? Not quite!

In this post, we’ll break it all down in plain English—what NAV is, why it matters, and how you should (and shouldn’t) use it when investing. Let’s dive in!

What Exactly is NAV?

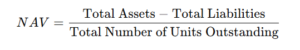

In the simplest terms, NAV is the price of one unit of a mutual fund. It’s calculated using this formula:

Still sounds too technical? Let’s simplify it.

Imagine a mutual fund is like a giant bowl of biryani (because why not?). If you divide that biryani into equal portions (units), NAV is basically the price of one plate. Just like a bigger bowl doesn’t necessarily mean tastier biryani, a higher NAV doesn’t mean a better mutual fund!

NAV is calculated once per day, after the stock market closes, because mutual funds invest in stocks, bonds, and other assets that change in value throughout the day.

Why Should You Care About NAV?

Now that you know what NAV is, let’s talk about why it matters to investors like you.

1. It’s the Buying Price of Mutual Fund Units

Whenever you invest in a mutual fund, you buy units based on the current NAV.

For example, let’s say:

- The NAV of a mutual fund is ₹50

- You invest ₹5,000

- You’ll get 100 units (₹5,000 ÷ ₹50)

Simple, right?

2. NAV Helps Track Your Investment Value

Your investment’s worth depends on the NAV. If you own 100 units and the NAV rises from ₹50 to ₹60, your investment is now worth ₹6,000. That’s a ₹1,000 gain without doing anything!

3. It’s NOT the Same as a Stock Price

Here’s where many new investors go wrong.

NAV is not like a stock price. Just because one fund has an NAV of ₹10 and another has ₹200 doesn’t mean the ₹10 fund is cheaper or better. The NAV just reflects the per-unit price, not the fund’s future growth potential.

So, don’t assume a lower NAV fund is a “better deal.” It’s not like shopping for discounts at Amazon!

Common Myths About NAV (And the Truth!)

Let’s bust some common NAV myths that often mislead investors.

❌ Myth #1: A Lower NAV Means a Cheaper Fund

✅ Truth: The NAV has nothing to do with whether a fund is expensive or cheap. What matters is how well the fund performs over time.

A new fund may start with an NAV of ₹10, while an older, well-performing fund may have an NAV of ₹200. That doesn’t mean the ₹10 fund is a better investment—it’s just newer.

❌ Myth #2: A High NAV Means the Fund is Overpriced

✅ Truth: A high NAV just means the fund has grown over time. It doesn’t make the fund expensive.

Think of it like this: If you invest in a 500g pack of almonds for ₹500, it’s the same as buying 1kg of almonds for ₹1,000. The total weight (investment value) matters, not just the price per pack (NAV).

❌ Myth #3: NAV Growth = More Profit

✅ Truth: NAV increases over time if the fund performs well, but your profits depend on when you invested.

If you buy units at ₹50 and sell at ₹70, you’ve made money. But if you buy at ₹70 and the NAV drops to ₹60, you’ve lost money. The key is long-term growth, not just daily NAV changes.

What Affects NAV?

NAV doesn’t change randomly—it’s influenced by real factors, such as:

📈 1. Stock Market Movements

If a mutual fund invests in stocks and those stocks rise, the NAV increases. If stock prices fall, so does the NAV.

💰 2. Fund Expenses

Every mutual fund has costs—fund manager fees, administrative expenses, etc. These costs are deducted from the total assets, which can slightly reduce NAV.

🏦 3. Dividends & Interest Earned

If a mutual fund receives dividends from stocks or interest from bonds, it increases the NAV.

🔄 4. Investors Buying or Selling Units

When more investors put money into the fund, the total assets grow. When many people redeem their units, the NAV might decrease slightly.

How Should You Use NAV When Investing?

Now that we know NAV is just a number, how should you use it the right way?

✔ 1. Focus on Returns, Not NAV

Instead of choosing funds with the lowest NAV, compare their past performance. A fund with an NAV of ₹150 that has grown consistently over 5 years is better than a ₹10 NAV fund with poor returns.

✔ 2. Pick Funds Based on Your Goals

- Want higher returns? Go for equity funds.

- Prefer stable, low-risk investments? Debt funds are better.

- Need short-term liquidity? Consider liquid funds.

Forget NAV—choose funds based on your financial goals.

✔ 3. Use SIPs to Average Out NAV Fluctuations

If you invest in a mutual fund through a Systematic Investment Plan (SIP), you buy units at different NAVs over time. This strategy is called rupee cost averaging, and it helps reduce the risk of buying at a high NAV.

Final Thoughts

NAV is important, but it’s just one piece of the puzzle when investing in mutual funds. The real focus should be on:

✅ The fund’s past performance

✅ The experience of the fund manager

✅ The risk level that matches your comfort

Key Takeaways:

- NAV is just the per-unit price of a mutual fund.

- A low NAV doesn’t mean a cheaper or better fund.

- NAV depends on market performance, fund expenses, and investor activity.

- Compare funds based on returns, not NAV.

So, next time someone tells you, “Buy this fund, its NAV is low!”—you’ll know better! 😎

If you found this helpful, share it with your friends who are starting their investment journey. And if you have any questions, drop them in the comments below! 🚀