Types of Mutual Funds: Which One is Right for You?

Investing in mutual funds can be one of the most effective ways to grow your wealth. However, with so many types available, it can be challenging to determine which one suits your financial goals. In this article, we will explore the different types of mutual funds and help you decide the best option for your investment needs.

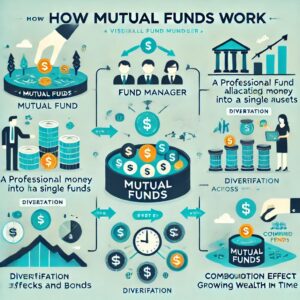

What Are Mutual Funds?

A mutual fund is an investment vehicle that pools money from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, or other securities. The fund is managed by professional portfolio managers who aim to maximize returns based on the fund’s objectives.

Mutual funds can be broadly classified into three main categories:

- Equity Funds (Invest in stocks)

- Debt Funds (Invest in fixed-income securities)

- Hybrid Funds (A mix of equity and debt instruments)

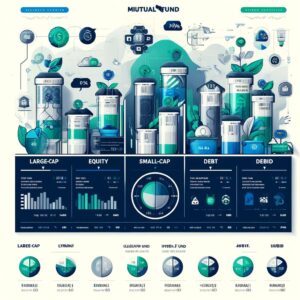

1. Equity Mutual Funds

Equity mutual funds primarily invest in stocks, making them ideal for long-term growth. However, they come with higher risk due to market fluctuations.

Types of Equity Funds:

| Type | Description |

|---|---|

| Large-Cap Funds | Invest in well-established companies with a strong track record. |

| Mid-Cap Funds | Focus on medium-sized companies with growth potential. |

| Small-Cap Funds | Invest in smaller, high-growth potential companies. |

| Multi-Cap Funds | Diversified investment across large, mid, and small-cap stocks. |

| Sectoral/Thematic Funds | Target specific industries, such as IT, pharma, or banking. |

| ELSS (Equity Linked Savings Scheme) | Offer tax benefits under Section 80C with a 3-year lock-in period. |

| Value & Contra Funds | Invest in undervalued stocks or take contrarian investment approaches. |

| Dividend Yield Funds | Focus on stocks that offer high dividend payouts. |

Who Should Invest?

- Investors looking for long-term capital growth.

- Those willing to take higher risks for potentially higher returns.

Example:

- If you invest ₹1 lakh in a Large Cap Fund, you may earn 10-12% annual returns over a long period.

- If you invest ₹1 lakh in a Small Cap Fund, the returns can be higher (15-18%), but with more risk.

2. Debt Mutual Funds

Debt mutual funds invest in fixed-income securities such as government bonds, corporate bonds, and treasury bills. They are suitable for investors looking for stability and regular income.

Types of Debt Funds:

| Type | Description |

| Liquid Funds | Invest in short-term securities with a maturity of up to 91 days. |

| Ultra-Short Duration Funds | Suitable for short-term investors seeking moderate returns. |

| Short-Term Bond Funds | Invest in bonds with maturities of 1-3 years. |

| Gilt Funds | Invest only in government securities, making them low-risk. |

| Credit Risk Funds | Invest in lower-rated corporate bonds with higher returns. |

| Dynamic Bond Funds | Adjust investment strategies based on interest rate movements. |

| Corporate Bond Funds | Focus on high-rated corporate bonds. |

Who Should Invest?

- Investors seeking stable returns with low to moderate risk.

- Those with short to medium-term financial goals.

Example:

- If you invest in a Liquid Fund, your money grows at 5-6% annually, but with zero lock-in period.

- If you invest in a Corporate Bond Fund, you may earn 7-9% annually with moderate risk.

3. Hybrid Mutual Funds

Hybrid mutual funds invest in a mix of equity and debt instruments, offering a balance between risk and return.

Types of Hybrid Funds:

| Type | Description |

| Aggressive Hybrid Funds | Invest mostly in equities (65-80%) with some debt exposure. |

| Balanced Hybrid Funds | Equally split between equity and debt instruments. |

| Conservative Hybrid Funds | Higher allocation to debt for lower risk. |

| Multi-Asset Allocation Funds | Invest in at least three asset classes. |

| Arbitrage Funds | Utilize price differences in equity markets for risk-free returns. |

Who Should Invest?

- Investors seeking a balanced risk-reward ratio.

- Those who want exposure to both equity and debt.

How to Choose the Right Mutual Fund?

The best mutual fund for you depends on:

✅ Your Investment Goal – Are you saving for retirement, a house, or wealth-building?

✅ Risk Appetite – Can you tolerate short-term market ups and downs?

✅ Investment Horizon – Are you investing for the short term (1-3 years) or long term (5+ years)?

Example Case Study:

-

Ravi (30 years, IT Professional)

- Goal: Retirement Planning (20 years investment)

- Best Choice: Flexi Cap Fund or ELSS Fund (High Returns)

-

Neha (40 years, Business Owner)

- Goal: Buying a house in 5 years

- Best Choice: Debt Fund or Hybrid Fund (Lower Risk)

-

Amit (55 years, Near Retirement)

- Goal: Regular Income with Safety

- Best Choice: Liquid Fund or Conservative Hybrid Fund

Common Mistakes to Avoid While Investing in Mutual Funds

❌ Investing Without Research – Many investors invest blindly without understanding fund performance.

❌ Trying to Time the Market – Mutual funds work best long term, so avoid panic-selling during downturns.

❌ Ignoring Expense Ratios – Higher fees can eat into your returns over time.

❌ Not Diversifying – Don’t put all your money into just one type of fund.

Future of Mutual Funds in India

✅ Rise of Passive Investing – More investors are moving towards Index Funds & ETFs for lower costs.

✅ Increased Digital Adoption – Platforms like Groww, Zerodha, and Paytm Money make investing easier.

✅ SEBI’s Strict Regulations – Investor protection is increasing with stricter guidelines for fund houses.

✅ International Investing – More funds are offering global investment opportunities for Indian investors.

Final Thoughts

Understanding the different types of mutual funds can help you make informed investment decisions. If you’re a risk-taker aiming for long-term wealth, equity funds might be the best fit. If stability is your priority, debt funds are ideal. For a balanced approach, hybrid funds provide the best of both worlds.

Always assess your financial goals and consult a financial advisor before investing. Start your mutual fund journey today and take a step towards financial freedom!

FAQs

- Which type of mutual fund is best for beginners?

- Beginners can start with index funds or balanced funds for moderate risk and diversification.

- Can I withdraw my money anytime from a mutual fund?

- Yes, except for funds with a lock-in period (e.g., ELSS, fixed-term funds).

- How much should I invest in mutual funds?

- It depends on your income, goals, and risk appetite. SIPs allow investments starting from ₹500.

- Are mutual funds safer than stocks?

- Mutual funds diversify risk, making them safer than investing in individual stocks.

- How do I start investing in mutual funds?

- You can invest through online platforms, financial advisors, or directly via AMC websites.

By choosing the right type of mutual fund, you can build a strong financial future while managing risks effectively. Happy investing!

Pingback: Mutual Funds Vs Stocks: Smart Investing For A Bright Future

Pingback: How To Start Investing In Mutual Funds And Grow Wealth With ₹500

Pingback: Understanding NAV: Why It Matters For Investors' Success