How to Start Investing in Mutual Funds with Just ₹500

Introduction

Investing in mutual funds no longer requires large sums of money. With as little as ₹500, you can start your investment journey and build long-term wealth. Thanks to systematic investment plans (SIPs) and user-friendly online platforms, investing has become more accessible than ever.

In this guide, we’ll walk you through everything you need to know about investing in mutual funds with a small amount, including how to start, the best options for beginners, and tips to maximize returns.

Why Invest in Mutual Funds with ₹500?

Many people believe that investing requires thousands of rupees, but that’s not true. Mutual funds allow you to start small and grow your investment over time. Here’s why investing with ₹500 makes sense:

- Affordability – You don’t need a large capital to begin.

- Compounding Benefits – Even small investments can grow significantly over time.

- Diversification – Your money is spread across different stocks and bonds, reducing risk.

- Discipline in Investing – SIPs encourage regular savings and financial discipline.

How to Start Investing in Mutual Funds with ₹500

Step 1: Understand the Basics of Mutual Funds

Before you start investing, it’s important to understand what mutual funds are. In simple terms, a mutual fund pools money from different investors and invests in stocks, bonds, or other securities. A professional fund manager handles these investments to generate returns for investors.

There are different types of mutual funds:

- Equity Mutual Funds – Invest in stocks and have higher returns but higher risk.

- Debt Mutual Funds – Invest in government bonds and fixed-income securities with lower risk.

- Hybrid Mutual Funds – A mix of equity and debt for balanced risk and return.

For beginners investing ₹500, starting with an SIP in an equity or hybrid mutual fund can be a great option.

Step 2: Choose the Right Mutual Fund

Not all mutual funds are the same. Here’s how to choose the best fund:

- Investment Goal: Are you investing for short-term gains or long-term wealth? Equity funds work well for long-term, while debt funds are better for short-term stability.

- Fund Performance: Check the fund’s past performance (at least 5 years). Look at returns and consistency.

- Expense Ratio: A lower expense ratio means more of your money is invested rather than spent on management fees.

- Fund Manager’s Experience: An experienced fund manager can make a big difference in your returns.

Some of the best mutual funds to start with ₹500 SIP include:

- SBI Bluechip Fund (Large-cap equity fund)

- HDFC Index Fund – Sensex Plan (Passive index fund)

- ICICI Prudential Balanced Advantage Fund (Hybrid mutual fund)

- Nippon India Small Cap Fund (For aggressive investors)

Step 3: Open an Investment Account

To invest in mutual funds, you need to open an account with a mutual fund house or an investment platform. Here’s how:

- Complete KYC Process – Submit your PAN card, Aadhaar card, and bank details. Most platforms offer e-KYC for quick verification.

- Choose a Mutual Fund Platform – You can invest directly through the mutual fund’s website or use platforms like:

- Set Up a SIP – Select your mutual fund, enter the investment amount (₹500 or more), and set up auto-debit for hassle-free investing.

Step 4: Start Your SIP and Monitor Your Investment

Once your SIP is active, your bank will automatically debit ₹500 every month. But investing doesn’t stop there—you need to track your investments.

- Check your portfolio every 3-6 months.

- Monitor the fund’s performance compared to benchmarks.

- Avoid withdrawing early—compounding works best when you stay invested long-term.

Step 5: Increase Your SIP Over Time

Starting with ₹500 is great, but as your income grows, increase your SIP amount. Even increasing your SIP by ₹500 every year can significantly boost your wealth over time.

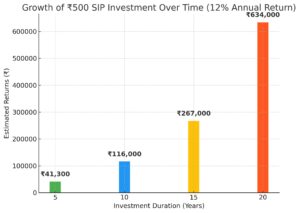

For example, if you invest ₹500 per month in an equity fund with an average return of 12%, here’s how your investment can grow:

| Years | Total Invested | Estimated Returns | Total Value |

|---|---|---|---|

| 5 | ₹30,000 | ₹9,650 | ₹39,650 |

| 10 | ₹60,000 | ₹59,000 | ₹1,19,000 |

| 15 | ₹90,000 | ₹2,53,000 | ₹3,43,000 |

| 20 | ₹1,20,000 | ₹7,82,000 | ₹9,02,000 |

As you can see, even ₹500 per month can grow into lakhs of rupees over time.

Common Mistakes to Avoid While Investing in Mutual Funds

1. Stopping SIP Due to Market Fluctuations

- Markets go up and down, but long-term investing smooths out volatility.

2. Investing Without a Goal

- Set a clear financial goal to stay motivated and disciplined.

3. Ignoring Expense Ratios & Exit Loads

- Always check fees and exit charges before investing.

4. Investing in Too Many Funds

- Stick to 2-3 good funds instead of spreading investments too thin.

5. Withdrawing Early

- Compounding benefits come only if you stay invested for 5+ years.

Conclusion

Starting your investment journey with just ₹500 is not only possible but also one of the best financial decisions you can make. With discipline, patience, and the right mutual funds, you can build long-term wealth effortlessly.

Whether you’re a student, a young professional, or someone looking to create a secure financial future, mutual funds provide an easy and effective way to grow your money.

So, why wait? Start your SIP today and let your ₹500 work for you! 🚀

FAQs

1. Can I start investing in mutual funds with ₹500?

Yes, many mutual funds allow you to start a SIP with just ₹500 per month.

2. Is it safe to invest in mutual funds?

Mutual funds are regulated by SEBI, making them a safe and transparent investment option. However, returns are subject to market risks.

3. How long should I stay invested?

For the best results, aim for 5-10 years or more to benefit from compounding.

4. Can I increase my SIP amount later?

Yes, you can increase your SIP anytime using the SIP top-up feature.

5. How do I withdraw my money?

You can redeem your mutual fund units anytime online. Some funds may have exit loads for early withdrawals.

Pingback: Understanding NAV: Why It Matters For Investors' Success