How Mutual Funds Work: A Step-by-Step Explanation

Mutual funds are a popular investment choice for individuals looking to grow their wealth without directly managing stocks or bonds. They offer a hassle-free way to invest while benefiting from professional management and diversification. Whether you’re a beginner or an experienced investor, understanding how mutual funds work can help you make informed financial decisions.

This guide provides a detailed, step-by-step explanation of mutual funds, their types, benefits, risks, and how you can start investing in them.

What is a Mutual Fund?

A mutual fund is a professionally managed investment vehicle that pools money from multiple investors and invests it in a diversified portfolio of stocks, bonds, or other securities.

Here’s a simple breakdown:

- Investors pool money together.

- A fund manager invests the pooled money in different financial instruments.

- Returns are distributed among investors in proportion to their investments.

Mutual funds are regulated by the Securities and Exchange Board of India (SEBI) in India and the Securities and Exchange Commission (SEC) in the U.S.

How Mutual Funds Work – A Step-by-Step Breakdown

Understanding how mutual funds work can help investors make better financial decisions. Below is a detailed step-by-step explanation:

Step 1: Pooling of Money

Investors deposit money into a mutual fund, and in return, they receive units or shares of the fund.

For example, if an investor contributes ₹10,000 to a mutual fund with a Net Asset Value (NAV) of ₹100 per unit, they will receive 100 units of the mutual fund.

Step 2: Professional Fund Management

Each mutual fund is managed by a fund manager or a team of financial experts. Their job is to:

Step 3: Investment Diversification

Mutual funds invest in multiple asset classes like:

- Equities (stocks) – High growth potential but higher risk.

- Bonds (debt instruments) – Lower risk with fixed returns.

- Commodities & Gold – Acts as a hedge against inflation.

- Real Estate Investment Trusts (REITs) – Allows investors to gain exposure to real estate.

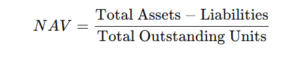

Step 4: NAV Calculation (Fund Value)

The Net Asset Value (NAV) represents the price of one unit of the mutual fund.

For example, if a mutual fund holds assets worth ₹50 lakh and has 10,000 units, the NAV per unit will be:

Step 5: Distribution of Returns

Investors earn returns in three ways:

- Capital Gains – If the fund’s value increases, investors can sell units at a higher NAV.

- Dividends – Some funds distribute a portion of profits to investors.

- Interest Income – Debt funds provide fixed income through bonds and securities.

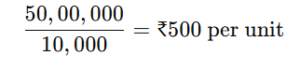

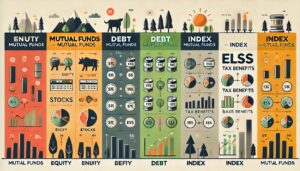

Types of Mutual Funds

Mutual funds are categorized based on risk, asset allocation, and investment strategy.

| Type of Mutual Fund | Description | Risk Level | Ideal For |

|---|---|---|---|

| Equity Funds | Invest in stocks for long-term growth | High | Investors looking for high returns |

| Debt Funds | Invest in bonds, government securities | Low | Conservative investors |

| Hybrid Funds | Mix of equity and debt | Medium | Balanced risk-takers |

| Index Funds | Tracks a stock market index | Low to Medium | Passive investors |

| ELSS (Tax Saving Funds) | Tax benefits under Section 80C | High | Tax-saving investors |

| Liquid Funds | Short-term investment in treasury bills | Low | Parking surplus funds |

Advantages of Investing in Mutual Funds

Risks Associated with Mutual Funds

How to Start Investing in Mutual Funds?

Step 1: Define Your Investment Goal

Before investing, ask yourself:

Step 2: Choose the Right Mutual Fund

Pick a fund based on:

Step 3: Select an Investment Mode

You can invest via:

- Lump Sum Investment – Invest a large amount at once.

- Systematic Investment Plan (SIP) – Invest small amounts regularly.

Step 4: Open an Account & Complete KYC

To invest in mutual funds in India, complete Know Your Customer (KYC) verification by providing:

You can invest via:

Step 5: Monitor & Rebalance Your Investment

Regularly review your mutual fund performance. If a fund underperforms, consider switching to a better option.

Mutual Funds vs. Other Investment Options

| Investment Option | Expected Returns | Risk Level | Liquidity |

|---|---|---|---|

| Mutual Funds | 8-15% | Medium | High |

| Stocks | 10-20% | High | High |

| Fixed Deposits (FDs) | 5-7% | Low | Medium |

| Real Estate | 10-12% | Medium to High | Low |

| Gold | 6-8% | Medium | High |

Conclusion

Understanding how mutual funds work is essential for smart investing. Mutual funds offer diversification, professional management, and flexibility, making them an excellent choice for both beginners and seasoned investors.

By selecting the right fund, following a disciplined investment strategy, and regularly reviewing your portfolio, you can maximize returns and achieve financial freedom.

Ready to Invest?

Start exploring mutual funds today and take your first step toward wealth creation!